-

-

recent posts

archives

- July 2015

- December 2013

- November 2013

- August 2013

- April 2013

- February 2013

- December 2012

- November 2012

- October 2012

- August 2012

- June 2012

- May 2012

- January 2012

- November 2011

- October 2011

- June 2011

- May 2011

- April 2011

- March 2011

- June 2010

- March 2010

- February 2010

- December 2009

- November 2009

- October 2009

- April 2009

- August 2008

categories

- Capital Markets

- Commercial Real Estate

- Completed Transactions

- Economic Recovery

- Innovation

- Landlord Financial Issues

- Lease Renewals

- Loan Delinquencies

- Macro Economy

- Market Statistics

- Misc.

- Never Be Defeated

- New Lease

- Press

- SQUARE FEET

- Sublease

- Sustainability

- Tenant Representation

- Uncategorized

- Workplace Strategy

-

Author Archives: Rhea Campbell - Bella Terra Partners LLC 2011

US GOVERNMENT REPORTS FINANCING FRAUD IN COMMERCIAL REAL ESTATE

A recent report released from The Financial Crimes Enforcement Network, a part of the US Department of Treasury, outlines the rising amount of suspicious activities in the Commercial Real Estate Industry. Between 2007 and 2010, the amount of Suspicious Activity Reports (SARs) regarding Commercial Real Estate financing fraud nearly tripled. The top 4 categories for these frauds were: false documents, misappropriation of funds, collusion-bank insider, and false statements. And, the top 5 locations of the reported subjects were: Georgia, Illinois, Florida, New York and California. In the last few years, commercial rents and occupancy rates have fallen and commercial loan defaults have risen. An estimated $1.4 trillion in Commercial Real Estate loans will reach the end of their terms by 2014. As financial institutions fear more loan defaults, they will be keeping a keen eye out for these kinds of suspicious activities.

MESSE DUSSELDORF RENEWS A LONG TERM OFFICE LEASE AT 150 N MICHIGAN AVENUE

Chicago, IL – March 1, 2011 – Germany based trade show organizer, Messe Düsseldorf North America (MDNA) has signed a long-term renewal lease at 150 N Michigan Avenue.

Messe Düsseldorf has been a tenant in the building for over 16 years and has excellent space overlooking Millennium Park in a location very convenient for their employee base. “SEB, the landlord of the building, was very accommodating, offering a compelling economic package to keep this tenant so renewing was a logical and easy choice,” said Rhea Campbell of Bella Terra Partners, who negotiated the transaction along with her colleague James Harrington. “The physical location coupled with the economic package was the ideal real estate solution to accommodate MDNA’s continued success here in the US,” she further commented.

Messe Düsseldorf is the world’s largest trade show event organizer helping to put on more than 20 worldwide events devoted to machinery, plant and equipment, trade and services, medicine and health, fashion and lifestyle and leisure. Messe Düsseldorf has a global presence, with 65 foreign representative offices serving 105 countries via 13 subsidiaries and associated companies.

IT’S JUST A ROUTINE LEASE RENEWAL

By underestimating the economic benefits to be gained from a routine renewal, tenants may miss a major cost-reduction opportunity.

Landlords are acutely aware of the difficulty tenants have in moving and will look to use this awareness to their advantage. The decision to renew or relocate should not be made solely on the basis of per-square-foot rental costs. Tenants need to evaluate “remain-in-place” issues such as:

- What’s the difference in required space needs at the current building vs. a relocation?

- What ability exists to upgrade the existing space for technological improvements and what capital is required to do so?

- What disruption to business will present itself during any renovation or upgrades to the space?

- What ability will remain to reshape the organizational image or culture, if desired, in the current space?

- What expansion opportunities exist in the current space?

- What opportunities exist to amend an existing lease and how can the tenant take control of the negotiation timetable?

Landlords believe they operate from a position of strength in a renewal negotiation because they perceive they have better market knowledge than the tenant, control of the process and timetable, and an appreciation of the tenant’s “inertia” and the real cost of moving.

Tenants can level the playing field by engaging a tenant representation professional to act on their behalf just as the landlord has his or her own brokerage professionals representing his or her interests. When a tenant engages a professional to represent them, the landlord will understand that the tenant is serious about pursuing relocation and that they will be aware of all relocation opportunities and “remain-in-place” issues. In other words, in engaging a tenant representation professional, a tenant will level the playing field by engaging their own team who will have the same information the tenant’s landlord does to evaluate renewal and relocation scenarios.

OUR APPROACH

Step 1- Create the Program

We start with a space planner who creates a “program” of a tenant’s space need. A program identifies the number of offices, cubes, conference rooms, server rooms and the like that is required for the operation to function optimally. It identifies adjacencies (where everyone sits for optimal collaboration) and allows tenants to rethink their business workflow. As tenants evaluate other spaces, the space planner will perform test fits to see how a tenant’s program works in alternative buildings. This exercise will validate how tenants can use the reworked space and confirm how much space tenants will need to take in a new location. Because of loss factors, building core types, and building layout, different buildings will require different footprints for the same program.

Step 2- Create the Financial Model

We then create a financial model for the renewal space allocating the costs and risks to the landlord associated with vacating a tenant’s space. This analysis should take into account the submarket and overall absorption trends of the area, lost income created by time the landlord will need to lease up the space when a tenant vacates, required tenant improvements for a new tenant taking a tenant’s space, and credit risk.

Step 3 – Conduct a Credible Market Search

A critical part of any successful renewal strategy includes a credible search of the market, showing a tenant’s landlord that they’re serious about looking into alternative locations in order to reduce occupancy costs.

Step 4 – Identify and List the Key Elements for Renewal Negotiations

A tenant’s ability to maximize the economic benefit which a tenant achieves if they renew will hinge on their ability to assist in shifting the “market or valuation risk” from them to the landlord.

Every tenant’s renewal strategy should be tailored based upon their current office building’s situation. However, there are four key elements that always need to be developed and implemented by your brokerage professional to execute a successful renewal strategy:

1. Lease Provisions-The tenant team must have a clear understanding of its lease provisions, utilize favorable clauses to its benefit, and prepare defenses against potentially harmful provisions.

2. Understanding the Landlord’s Objectives/Constraints-A tenant’s brokerage professional should understand the issues and implications of the building’s current situation, including ownership profile and their financial objectives, building debt, tenant profile, including credit, rental rate proformas, rollover, and the market perspective.

3. Timing-A tenant must develop its occupancy strategy early enough to allow for a renewal to be developed outside of the renewal rights in the lease. The potential exists to negotiate terms and conditions tailored to a tenant’s needs while providing certainty to all parties.

4. Well-Defined Tenant Objectives-The tenant team must clearly define its renewal goals in terms of rent, escalations, work contribution, options and other lease rights. A tenant’s ability to define specific “target” prior to approaching the landlord will increase a tenant’s credibility with the landlord and ultimately the likelihood of a successful, fair market renewal.

What a tenant perceives as favorable renewal terms may be a downright steal to the landlord.

COULD THE GROWTH OF THE COMMERCIAL REAL ESTATE MARKET BE JUST AROUND THE CORNER?

Sam Chandon, global chief economist of Real Capital Analytics writes an excellent article at The New York Observer titled: Why the Rosier Employment Report Still Falls Short. To summarize, he believes the recent employment report paints a very optimistic picture about the rise of jobs and the overall improvement of the economy. After all, February saw the largest one-month improvement in jobs added to the US market since May 2010. However, due to factors such as the slow rate of job growth and rising global political and economical conditions, the commercial real estate sector, in particular, may see a slower increase in business than expected.

Chandon writes:

“In areas that are more directly relevant for prime office-space demand, the results have been consistently disappointing. Information services reported no increase in jobs in February. In the financial services sector, employment fell by 2,000 jobs over the month; and this sector has almost 50,000 fewer jobs than a year earlier. While many financial institutions have reported robust recoveries in profit levels, these gains have yet to translate into an observable improvement in the sector’s overall employment levels.”

We agree with Chandon. One month of job gains does not a trend make.

CMBS DELINQUENCY RATE JUMPS 40 BASIS POINTS IN MAY – RATE NOW 8.42%

As reported by TREPP the delinquency rate for commercial real estate loans in CMBS continued to move higher in May as the monthly rate of increase has demonstrated remarkable consistency.

Specifically, office delinquency approaches 6% up 44bps. This property type has seen continual increases month over month since May of 2009.

And the beat goes on….

300 N LASALLE – FOR SALE

This is the first major commercial real estate offering of the year. Last year this market saw only one major real estate deal completed for just over $60M. What will this one fetch in this market?

See the full article here.

IPD ANNUAL REAL ESTATE INDEX

IPD has just released the results of the US Annual Index which reports a second consecutive year of declining commercial real estate values, and the worst on record. Capital values dropped another -22.4% to December 2009, taking the total return for the year to -17.1%. Combined with an -11.9% drop in values during 2008 the total decline in US real estate values sits at -31.7% from the peak at December 2007.

See the full report here.

DURABLE GOODS – LEADING INDICATOR FOR OFFICE SPACE ABSORPTION

Durable Goods orders decrease when you extrapolate transportation.

“New orders for manufactured durable goods in January increased $5.2 billion or 3.0 percent to $175.7 billion, the U.S. Census Bureau announced today. This was the second consecutive monthly increase and followed a 1.9 percent December increase. Excluding transportation, new orders decreased 0.6 percent. Excluding defense, new orders increased 1.6 percent.”

Most important in the “new orders” column is the decrease in computers and electronic components. Orders for new computer equipment and cell phones mean jobs. Jobs drive office space absorption. The Durable Goods numbers tell us very little computer equipment = very few jobs = very little office space absorption.

It remains an excellent time to be a tenant in the market.

2010 – TENANTS WILL REMAIN FIRMLY IN CONTROL

Because more firms plan to layoff workers than hire workers tenants will remain firmly in control in the Chicago office market.

Employment drives office space consumption, period. Without jobs creation there is no demand for office space. Lack of demand for office space will leave the glut of sublease space on the market to languish and continue to force building owners to complete directly with this deeply discounted space.

IT’S ONLY JUST BEGUN

Tom Corfman writes,

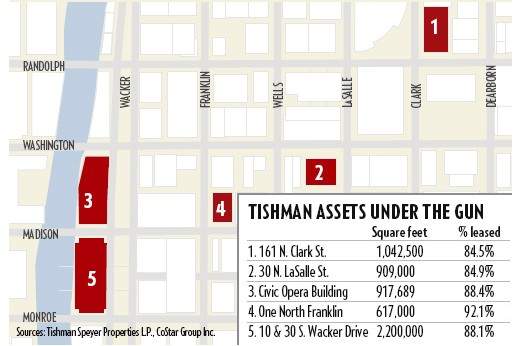

“the largest real estate deal in Chicago history is turning into the biggest example of the grim plight of many properties in the city’s downtown office market.

A venture led by New York-based Tishman Speyer Properties has defaulted on part of a package of loans used to finance the $1.72-billion purchase of six prime office towers in Chicago’s Loop during the frenzied real estate market of 2007, sources familiar with the deal say.”