-

-

recent posts

archives

- July 2015

- December 2013

- November 2013

- August 2013

- April 2013

- February 2013

- December 2012

- November 2012

- October 2012

- August 2012

- June 2012

- May 2012

- January 2012

- November 2011

- October 2011

- June 2011

- May 2011

- April 2011

- March 2011

- June 2010

- March 2010

- February 2010

- December 2009

- November 2009

- October 2009

- April 2009

- August 2008

categories

- Capital Markets

- Commercial Real Estate

- Completed Transactions

- Economic Recovery

- Innovation

- Landlord Financial Issues

- Lease Renewals

- Loan Delinquencies

- Macro Economy

- Market Statistics

- Misc.

- Never Be Defeated

- New Lease

- Press

- SQUARE FEET

- Sublease

- Sustainability

- Tenant Representation

- Uncategorized

- Workplace Strategy

-

Monthly Archives: December 2012

BECOMING A US CITIZEN – A PERSONAL JOURNEY

I was born in Canada but have lived in this country for the last 13 years with work visas and eventually a green card, which I obtained when I married my husband, Alex. I decided to become a US citizen when our attorney suggested that doing so would make things easier for estate planning purposes.

My appointment to take the oath to become a US citizen was set for Friday November 30th at 9 am at the United States Immigration Service (USIS) office in downtown Chicago. When I arrived I was ushered through through metal detectors by security officers who didn’t seem the least bit interested in being friendly, attentive, or polite. After I reached the second floor I was told to sit in a very specific area of the waiting room (“Between these lines here, not those lines there“) with the mass of other immigrants. A government officer began getting us up row-by-row to enter the auditorium. (They were exceptionally concerned that we did this row-by-row and at a certain, controllable speed.) It annoyed me that they were moving us into the auditorium in such an inefficient way rather than simply having everyone walk into the room and sit down. I had things to do and wanted to get the citizenship ceremony over and done with.

Once we were all seated in the auditorium, the same officer who walked us in then had us get up—again row-by-row—to walk back out to the foyer, hand in our alien registration cards (i.e., green cards) to waiting USIS officers, and take a number. Why didn’t they just have us do this on the way in to the auditorium? I had no idea and as a result became increasingly frustrated. I had scheduled a meeting with a client at his office just around the corner, but there was no cell phone signal in the auditorium where we were being held. Fed up, I finally told an agent that I had to go the bathroom (which was apparently the only reason that would justify me leaving my seat at that point) to find a strong enough cell phone signal in the lobby of the building to pop off an email explaining that I was going to being late. That done, I reentered the auditorium resigned to the fact that this was going to be a long, boring process and that I just needed to be patient.

After an hour, the opening of the ceremony at last began. A video appeared on a large screen at the front of the room. It started by showing old photographs of people of differing nationalities coming in on boats, of families embracing, of American cities gradually expanding as a result of the back-breaking work of immigrants. At this point, I began to pay attention. I looked around at the other 145 immigrants seated with me in the auditorium—immigrants from countries like Albania, Bangladesh, Iraq, Iran, China, India, Mexico and so on—and it suddenly dawned on me that for many of them the ceremony in which we were all about to take part marked the end of a long and painful struggle to secure a better life—for them, their families, and their future generations.

Then the director of the facility—a naturalized US citizen herself, we soon learned—came onstage and spoke to us about the privilege US citizenship carries: about freedom of speech, benefits, a safe food chain, the right to vote for both men and women, and so on. I suddenly began to get emotional, my impatience (about which I felt suddenly embarrassed) quickly shifting to gratitude for having been being born a Canadian, which had afforded me the opportunity to become an American. I didn’t have to fight, literally or figuratively, to be standing there. But many of my fellow new citizens, I suddenly understood, were from countries where speech is not free, where women often felt fear of rape and hunger on a daily basis. Some of the people around me, I realized, had struggled through horrors I’d couldn’t imagine to be able to stand in that place, a place only an hour before I’d been annoyed I had to spend so much time in, and I felt at once humbled and privileged to be standing beside them as I took the same solemn oath. I continued to look around the room while the director spoke about the significance of getting to this place—the Oath Ceremony—a privilege that is only bestowed on a few lucky individuals. Standing with me were people young and old, some dressed in saris, some in turbans, some in suits—but all of us there to become US citizens, full of hope and excitement about out futures.

After the director’s speech we were told a list of each country would be read out loud, and we were asked to stand when we heard our country’s name. “Albania!” came the first, and a few people in the group stood, all with joyful smiles. “Canada!” I heard soon, and I stood, smiling the same smile as the rest, looking around for any fellow countrymen (I didn’t see any).

Once the entire room was standing the director of the office moved that we become US citizens, which was then seconded by another officer officiating at the ceremony. I wasn’t the only one crying as we proceeded to pledge our allegiance to the flag of the United States of America.

We were asked to sit and then (again) row-by-row come up to receive our certificate of naturalization. As each row stood, I looked again at the faces of my fellow immigrants and thought what I now saw reflected in their smiles was the grit that had ultimately enabled them to reach this place. I was no longer irritated or impatient. I was grateful for the freedom I’ve been privileged to experience as a Canadian—and now an American.

Unexpectedly, the ceremony in which I became a US citizen has come to represent a milestone in my life. I’ve never had to fear being raped, or hunger, or imprisonment for simply speaking my mind. I’ve had my basic human rights secured by the founders of this country who in some cases traded their lives for the freedom of their children and fellow countrymen—by people who never met me but whose actions have powerfully influenced the direction of my life. I came away from the swearing-in ceremony with a new appreciation for the privileges afforded us by citizenship in this country, and after watching my fellow new citizens’ faces as they took their oath, I will never forget how large a place the planet is and just how lucky we few Americans are.

THE VALUE OF A LEASE COMP

Using lease comps to assist a client in understanding where their lease economics should end up at the end of a negotiation needs to be reviewed. Prospective clients are told how important it is for a brokerage firm to have these details – and lots of them – to use in helping establish their negotiation end-point.

“Hogwash!”, I say.

Leverage is what establishes the bottom of the barrel economics with landlords not lease comps.

Every deal is unique, every client is unique. Reliance on lease comps is a poor substitute for applying a process that drives the outcome. Even if you could standardize the transaction details, all a comp represents is a unique set of conditions in a single moment of time that cannot easily be generalized to any other deal. You get all you need to know about where prices are going by looking at asking lease rate trends, applying a process to create leverage and letting the process drive the outcome.

CHICAGO MARKET OUTLOOK Q3 2012

Signs of Life Continue

Chicago’s economy – along with the downtown office leasing market – continue to show signs of life.

Important indicators, like unemployment, vacancies, absorption, and rental rates, continued to improve this quarter. We’ve seen demand from historically suburban-based

companies like Sara Lee, Google and others, relocating downtown. And, we’ve seen increased demand from technology companies as Chicago focuses on building jobs in this sector.

The Chicago Economy

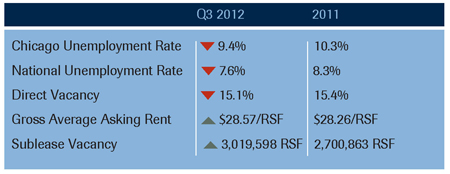

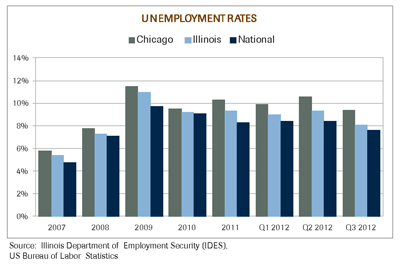

Chicago’s unemployment rate fell to 9.4% at the end of Q3 2012, the lowest rate since 2008. This may be a hopeful sign for the Chicago economy, but it is still well above the state and national average.

Though we’ve seen some improvement in the Nonfarm Payrolls prints over the last few months, there are not enough jobs to sustain a strong recovery, and therefore, a strong landlord market. A significant proportion of those jobs, however, are in occupations whose growth bodes well for the CBD real estate market. One analysis shows that as much as 17% of available jobs are in information technology fields, with 13% in management, 10% in office and administrative support, and 8% in business and financial. With job gains distributed among these fields, even small increases will result in increased demand for downtown office space.

Chicago’s volatile 2009 – 2012 job market has made employers cautious in making real estate commitments. Unemployment data are notoriously opaque, and there is rarely consensus about the exact reasons behind changes in the unemployment rate. Variations in the city’s labor force participation rate, for example, along with the extension of unemployment benefits, can affect the unemployment rate in non-intuitive ways. The recovery continues to grind along slowly and is expected to be drawn out over many years.

Demand rises slightly in Chicago’s central business district

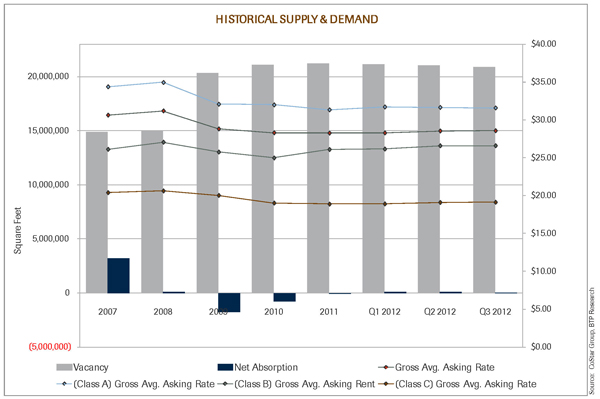

Small changes continue in CBD real estate indicators: direct vacancies are down slightly (to 15.1%) and rents are up slightly (to $28.57), showing that the market is starting to see modest increases in demand. The drop in vacancies is due to a number of factors: some employers are hiring or rehiring, some are hanging onto leases in anticipation of being able to return to a pre-recession workforce, and some are entering the CBD real estate market for the first time, relocating from suburban markets.

Absorption, which is the difference between the amount of space leased and taken off the market and the amount put back on the market, paints a similar picture. Class B absorption is highest at 78,760 rentable square feet. This is followed by Class C and then Class A, both of which had negative absorption for the quarter. Despite this, overall absorption was positive in Q3 2012 at 54,188 RSF. In fact, it has been positive for the first three quarters of 2012. The CBD has been stuck in a negative annual net absorption trend since 2009, but we expect this trend to reverse by year end.The changes in demand stand out much more clearly within each of the three divisions of downtown real estate. The mid-level, Class B (space that’s good, but not spectacular) is in slightly greater demand, with a 14.5% vacancy rate this quarter, followed by the prime real estate in Class A with 14.8%. In contrast, Class C space demand (the lowest-rung) is weak at 19.0%. All three classes have seen vacancy decline from last quarter. The River North submarket has the lowest vacancy rate at 9.2%.

Rental rates for the quarter largely correspond to vacancies and absorption, with a couple of variations. Class B space, particularly in River North, is in the highest demand. With this, the average Class B rates have climbed slightly to $26.59. Meanwhile, Class A space has seen a small reduction in average asking rates as the rate dropped to $31.58 from $31.65 last quarter. This may correlate to the negative absorption reported among Class A space for the quarter. Rates have increased slightly in Class C space to $19.12 (this reflects the low rents in many Class C properties, which in many cases can’t be further reduced). Class B rates continue to inch closer to Class A rents. In fact, as of this quarter, they’re closer than they’ve been for the last 7 years – which may inspire some Class B tenants to make a leap up to Class A. For a price differential that’s at a historic low, they would achieve a sizable upgrade in their surroundings.

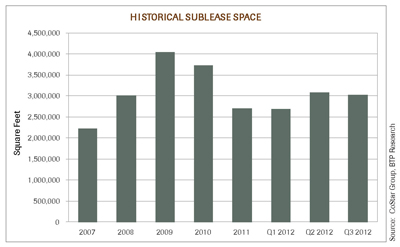

Sublease Space

Sublease Space

Overall, Q3 2012 shows a modest decrease in space available for sublease. As economic prospects improve, employers feel less need to cut internal expenses by subleasing out their space. In a weak landlord market, sublease space competes with direct space making disposition difficult even for quality space. As a result, some companies will forgo subleasing if they have a short amount of lease term left. Also, when their lease expires, they may no longer need as much space per employee due to alternative workplace strategies and increased employee density metrics. Everyone is trying to make do with less and the second place employers looks for efficiency is in the amount of space they occupy.

New Developments

There are several proposed office developments for downtown Chicago. Some of these may secure an anchor tenant over the next year, but competition for prime space will remain tight. During Q4 2012, Hines is expected to break ground on their proposed 45-story office tower at 444 W Lake that is to be completed by 2016. Wolf Point is being built on spec (meaning they do not yet have an anchor tenant). Several large tenants are already contemplating relocating. So, the game of musical chairs will continue. A redevelopment by Sterling Bay Partners is underway for the Fulton Cold Market Storage at 1000 W Fulton St. The warehouse is being converted to loft-style office space that is currently in high demand among the tech sector. In fact, they have already secured a 77,000 user – SRAM – to occupy the building once done. Overall, the CBD is starting to see a constraint in the amount of large blocks of space that are available, making a move by the big boys difficult and competitive.

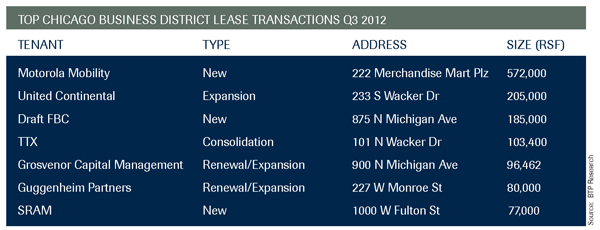

Who’s Moving the Market?

Motorola Mobility (recently acquired by Google) led the market this quarter with its announcement to move its headquarters and 3,000+ jobs from suburban Libertyville to the top four floors of the Merchandise Mart. In fact, Google will receive nearly $55.8 million from the Merchandise Mart’s owner to cover the upfront expenses of moving its Motorola Mobility division, according to a Securities and Exchange Commission filing by the building’s owner, Vornado Realty Trust. That works out to $97.50 per RSF for Motorola Mobility to build out its new River North space.

United Continental Holdings expanded its presence at the iconic Willis Tower to a total of 830,000 square feet. It will soon occupy 25% of the building. Draft FBC followed suit with United in consolidating its employees from 2 locations in another iconic Chicago building – the John Hancock. By and large, technology companies led the way with business services and transportation companies a short lag behind.

Where Is the Opportunity?

It continues to be a good time for tenants looking for office space in the Chicago Business District. Rents are lower, overall, than pre-downturn levels and landlords are still offering generous concessions to lure creditworthy tenants. Class A space rents are closer to Class B prices than they have been for several years. This provides opportunity for companies currently occupying Class B or C space to significantly upgrade their aesthetic without breaking their budgets. Small to mid-sized companies, particularly, have broad space options downtown. If they are creditworthy, they have the upper hand in negotiating favorable rates and concessions with landlords.

As more companies flock downtown to attract young talent, landlords are anticipated to become more bullish in 2013. In fact, we have already seen many of them pushing back on rents and concessions in our recent negotiations. Now is the time. Get in while rates are low.