-

-

recent posts

archives

- July 2015

- December 2013

- November 2013

- August 2013

- April 2013

- February 2013

- December 2012

- November 2012

- October 2012

- August 2012

- June 2012

- May 2012

- January 2012

- November 2011

- October 2011

- June 2011

- May 2011

- April 2011

- March 2011

- June 2010

- March 2010

- February 2010

- December 2009

- November 2009

- October 2009

- April 2009

- August 2008

categories

- Capital Markets

- Commercial Real Estate

- Completed Transactions

- Economic Recovery

- Innovation

- Landlord Financial Issues

- Lease Renewals

- Loan Delinquencies

- Macro Economy

- Market Statistics

- Misc.

- Never Be Defeated

- New Lease

- Press

- SQUARE FEET

- Sublease

- Sustainability

- Tenant Representation

- Uncategorized

- Workplace Strategy

-

Monthly Archives: December 2009

2010 – TENANTS WILL REMAIN FIRMLY IN CONTROL

Because more firms plan to layoff workers than hire workers tenants will remain firmly in control in the Chicago office market.

Employment drives office space consumption, period. Without jobs creation there is no demand for office space. Lack of demand for office space will leave the glut of sublease space on the market to languish and continue to force building owners to complete directly with this deeply discounted space.

IT’S ONLY JUST BEGUN

Tom Corfman writes,

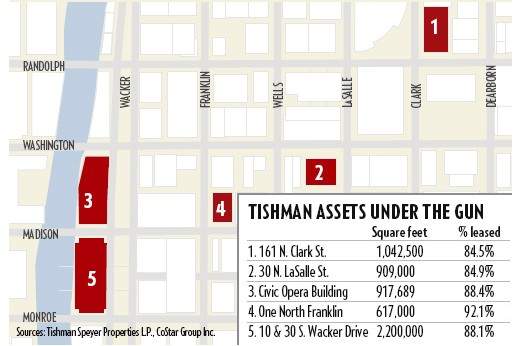

“the largest real estate deal in Chicago history is turning into the biggest example of the grim plight of many properties in the city’s downtown office market.

A venture led by New York-based Tishman Speyer Properties has defaulted on part of a package of loans used to finance the $1.72-billion purchase of six prime office towers in Chicago’s Loop during the frenzied real estate market of 2007, sources familiar with the deal say.”